LETTER

FROM OUR CEO

Our world has changed significantly since we launched our five-year strategic plan in September 2023. Although the environment around us has shifted dramatically, I am grateful for the strong foundation that keeps us grounded.

LETTER

FROM OUR CEO

Our world has changed significantly since we launched our five-year strategic plan in September 2023. Although the environment around us has shifted dramatically, I am grateful for the strong foundation that keeps us grounded.

Deep staffing and resource cuts at the federal level have forced us to ask: what does this mean for organizations like True Access Capital (TAC), which for years have partnered with government to invest in underrepresented communities across Delaware and southeastern Pennsylvania? The answer is clear; it means we must become an even better, stronger, and more efficient organization, one that is able to adapt quickly while staying true to our mission.

Two years into our strategic plan, I am pleased to report that we have made meaningful progress despite these challenges. We have expanded our programs, strengthened internal operations, and deepened partnerships, all with the goal of creating greater impact for the small businesses and entrepreneurs that we serve. Each step forward demonstrates the resilience of our organization and our unwavering commitment to empower communities throughout our region.

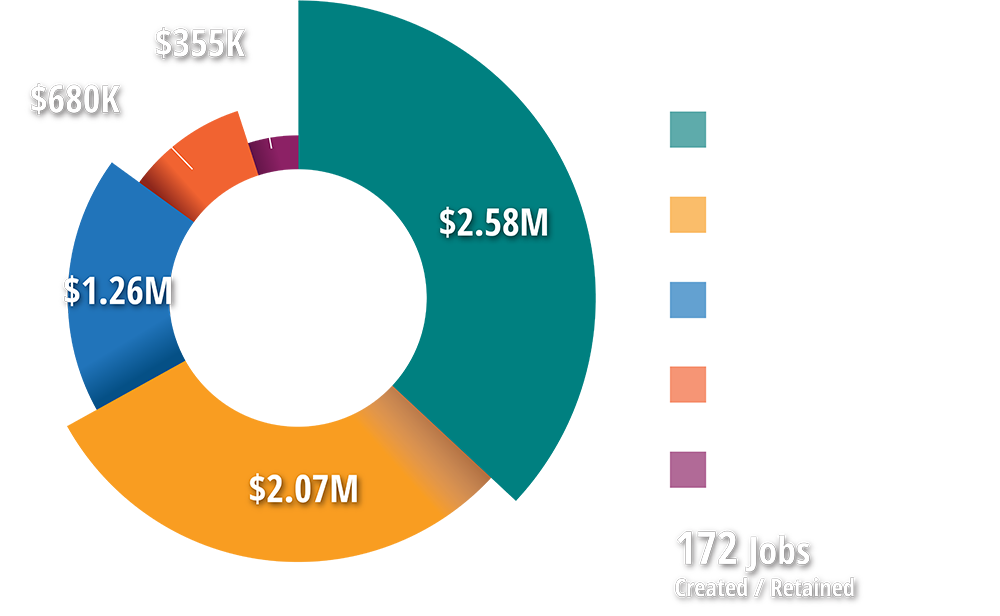

That commitment is evident. Over the past year and half, TAC deployed $6.9 million in new loans, 60% going to businesses in Delaware and 40% to businesses in southeastern Pennsylvania. These investments have created or retained 172 jobs, reaching the communities that need us most: 73% of loans went to people of color, 53% to low-income individuals, and 40% to women.

People of Color

Low Income People

Our Women’s Business Center (WBC) also had a remarkable year, highlighted by the H.E.R. (Helping Entrepreneurs Rise) Business Plan Competition. The WBC received 57 submissions from women entrepreneurs, each of whom took the time to complete a full business plan, which that alone is a tremendous accomplishment. By going through the process, these women gained the knowledge and discipline to strengthen their businesses for the future. In our eyes, they are all winners, because they leave the competition better prepared, more resilient, and empowered to succeed.

These are challenging times, but TAC remains steadfast in our mission and in our commitment to the small businesses and community organizations that we serve. I am truly grateful for the opportunity to support resilient entrepreneurs and to walk alongside partners who share our vision. Together, we will continue to strengthen communities throughout our region.

Our Impact 2024–2025

(Jan 2024 – June 2025)

Lending by Geography

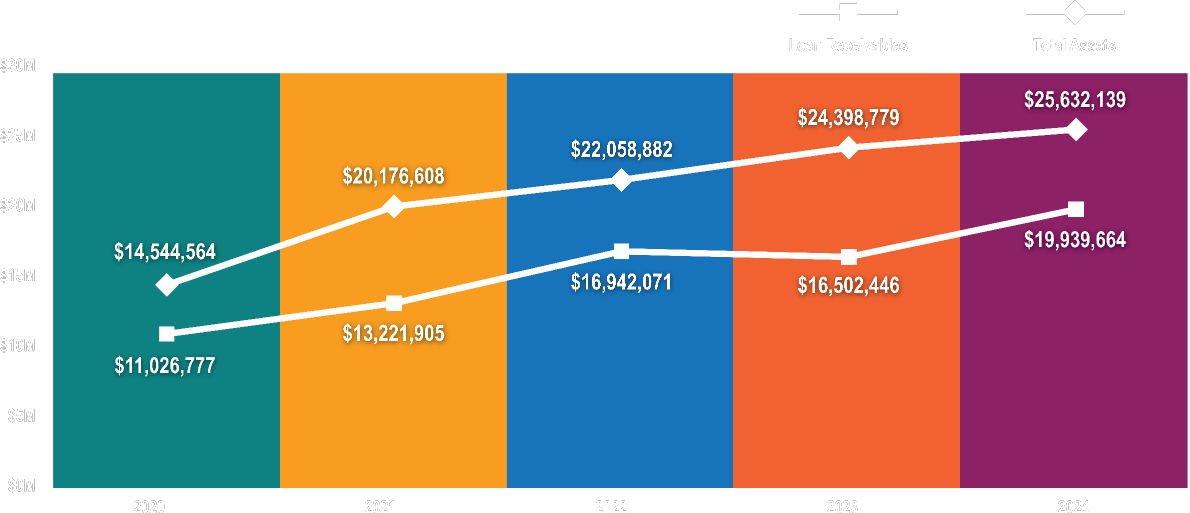

ASSETS

Financials

| STATEMENT OF FINANCIAL POSITION | 2022 | 2023 | 2024 |

| Total Assets | $22,058,882 | $24,398,779 | $25,632,139 |

| Net Liabilities | $11,751,599 | $13,702,100 | $14,088,039 |

| Total Net Assets | $10,307,283 | $10,696,679 | $11,544,100 |

| Total Liabilities & Net Assets | $22,058,882 | $24,398,779 | $25,632,139 |

| STATEMENT OF ACTIVITIES | |||

| Total Income | $3,163,889 | $3,817,315 | $4,670,432 |

| Total Expenses | $3,531,069 | $3,427,919 | $3,823,011 |

| Change in Net Assets | $(367,180) | $389,396 | $847,421 |

Investors / Contributors

Investors

Artisans’ Bank

Barclays Bank of Delaware

Common Spirit Health

Citizens Bank

Customers Bank

Delaware Community Foundation

First Unitarian Church of Wilmington

HSBC

Kennett Borough

Northern Trust

Opportunity Finance Network

PNC Bank

U.S. Small Business Administration

TD Bank, N.A.

USDA – Rural Development

WSFS Bank

Individual Contributors

Clinton Tymes

Daniel Kempski

Pedro Viera Jr.

Vandell Hampton, Jr.

Contributors

Allen House Studios

Artisans’ Bank

Bank of America

Citizens Bank

City of Wilmington

Comenity Bank

Delaware Community Foundation

Delaware State University

Discover Bank

JP Morgan Chase Foundation

Laffey-McHugh Foundation

Longwood Foundation

M&T Bank

PNC Bank

Santander Bank

State of Delaware

TD Bank, N.A.

U.S. Small Business Administration

USDA – Rural Development

Wells Fargo Foundation

WSFS Bank

Board of Directors

Justin D. Poser

Chairperson

Executive Vice President

M&T Bank

Barry L. Lott

Secretary

Director

National Council on Aging (NCOA)

Rafael X. Zahralddin, Esq.

Partner

Lewis Brisbois

Gregory M. Makosky

Vice President

Artisans Bank

Joseph W. Wilson

Vice President

PNC Bank

Rachael Mears

Treasurer

Assistant Vice President

Synchrony Bank

Emanuel V. DeShields

Principal

Be Ready Community Development Corp.

Lissa Brutus

Assistant Vice President

WSFS Bank

Helen R. Foster, JD

Small Business Enterprise Coordinator

New Castle County Government

Derrick R Robinson

Executive Director

J.P. Morgan Chase & Co

Thomas E. Hanson, Jr., Esq.

Vice Chairperson

Partner

Barnes & Thornburg

Robert Gunter, Sr.

Associate

JPMorgan Chase

Ron Kimbrough

Executive Committee Member

Senior Vice President

Citi Treasury & Trade Solutions

Jerry A. Alfano, Jr.

Senior Vice President

Citizens Bank