For 18 months, we’ve stood in the gap. The gap between making payroll and closing the doors. The gap between thriving and failing. The gap between dreams and reality.

TRUE ACCESS CAPITAL 2020 ANNUAL REPORT

WOMENS BUSINESS CENTER AT TRUE ACCESS CAPITAL

The Women’s Business Center at True Access Capital (WBC) provides intensive business training and in-depth technical assistance and services to assist both women and men. The WBC provides trainings, events, and one-on-one counseling. WBC covers fundamental and higher level trainings to assist in starting or growing a business.

Our partnerships with the Small Business Association (SBA), Service Core of Retired Executives (SCORE) the Small Business Development Center (SBDC) and State agencies provide additional resources to our clients.

WBC maintains a focus on ensuring entrepreneurs obtain the fundamentals of solid business development and finance through offering courses such as Passport to Business Success, Community UP! and Bookkeeping & QuickBooks for Small Business. Additional courses such as Be a Brand with a plan, Building a business culture, and Being legal in business help business owners strengthen their fundamentals and improve business effectiveness for long-term sustainability.

While trainings, events, and counseling opportunities have been virtual during the COVID-19 pandemic, we eagerly look forward to in-person opportunities for sharing and networking in the near future.

Here are some of our accomplishments in 2020:

- Continued working in underserved and disadvantaged areas to support emerging entrepreneurs throughout Delaware.

- Trained 1000 people, counseled 255, and hosted 84 trainings and events to educate our communities, small businesses and aspiring business owners.

- Assisted in helping secure $100,000 in COVID-19 Relief loans for small business owners.

- Led and curated our 4th Her Story, Our History event in celebration of Women’s History Month honoring 10 women in business and community changemakers.

- Created The H.E.R. Business Plan Competition in partnership with True Access Capital and Citizens Bank to secure capital for small businesses.

- Worked closely with The Association of Women’s Business Centers to bring national-level opportunities to small business owners in our coverage areas.

- Created an E-Commerce Program in partnership with PNC Bank, to assist in transitioning businesses to an online platform to engage their customers, increase visibility, and increase revenue.

- Created The Holiday Crawl an online virtual QVC Style platform for clients to engage new and old customers to sell and pitch theirs business and or products or services.

- Hosted financial literacy trainings on bookkeeping, COVID-19 relief funding, and business loan options.

- Hosted our 1st Virtual Connect Series Event due to COVID-19.

PROUD TO BE STANDING IN THE GAP

In 2020, when small businesses were under attack by COVID-19 restrictions and a suffering national economy, we at true Access Capital felt like defenders “Standing in the Gap.”

That reference goes back to ancient times when only a wall protected ancient cities. Defenders would rush to any breach in the wall to stop the enemy until the gap could be repaired. If a breach was left unattended or unrepaired, a city could fall.

That’s why we at True Access Capital chose that phrase as our theme to this Annual Report. When COVID attacked and the restrictions stretched into months, so many businesses were suffering. Some couldn’t pay the rent or salaries, couldn’t afford to buy products and materials. They needed help urgently.

Providing a Buttress

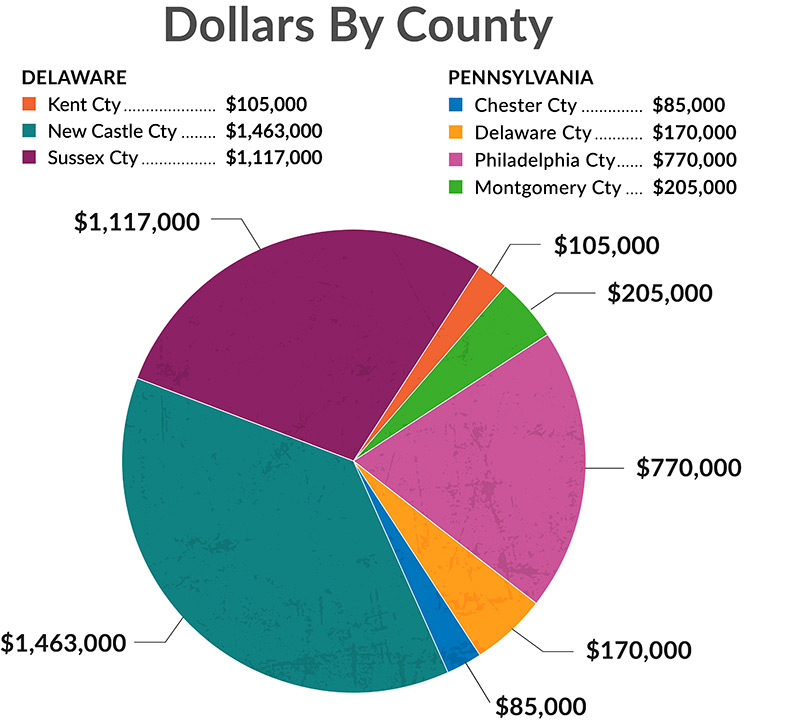

As a certified Community Development Financial Institution (CDFI), we provide small business loans from $10,000 to $500,000 and community development loans of up to $500,000.

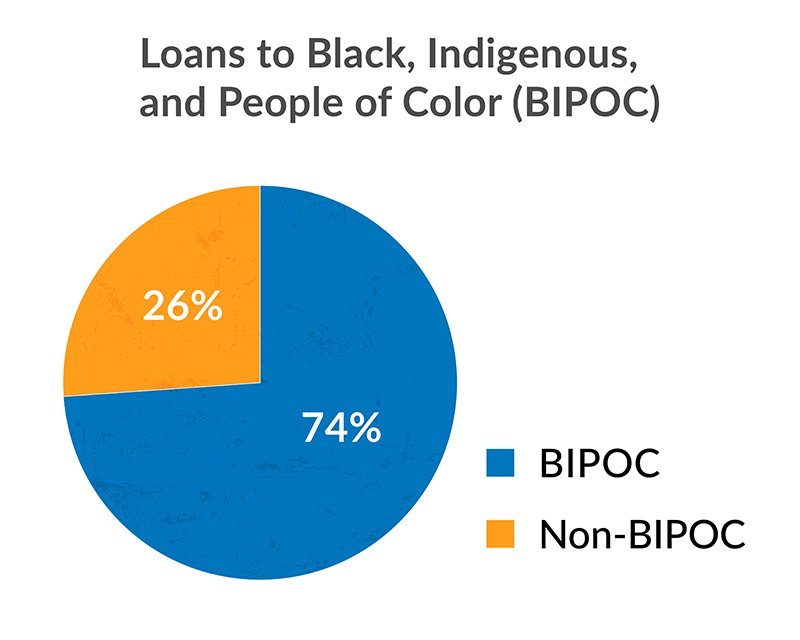

During 2020, many of the small, BIPOC-owned businesses that TAC serves were not able to qualify for state and federal COVID rescue loans. These businesses – many of which were located in lower-income communities of color—were at risk of closing or suffering catastrophic financial losses.

In response, TAC conceptualized and implemented the Emergency Relief and Recovery Loan and Grant program that offered a low-interest loan up to $20,000 with interest and principal payments deferred for the first six to 12 months and an additional $5,000 grant when funds were available.

At the same time, we entered into a partnership with the Borough of Kennett Square to create the Kennett Square Community Relief Fund.

Concurrently we moved our training programs to a virtual model and stepped up to meet increased need for one-on-one counseling and technical assistance through phone meetings, emails and Zoom sessions.

Proud Community Supporter

In this report you will see more detail about these programs and you will read about businesses that were able to hold on with an assist from True Access Capital. Every one of these stories proves that even in a worldwide crisis, acting locally and strategically can underpin our economy and contribute in a meaningful way to local, small business success. We are proud to be of service to our community.

Sara A. Crawford, Program Director

El Centro de Negocios para Mujeres de True Access Capital

The past four years working with the eager entrepreneurial women of our community have been as enlightening for me as for those who came to the Women’s Business Center for guidance and education. I come from a family of entrepreneurs and I started out my professional life as a fashion designer who immediately found myself in the business school of hard knocks. I learned first-hand that becoming a successful entrepreneur is a journey of self-discovery, discipline, dedication, personal growth and getting up after a fall.

That lesson is why the WBC is dedicated to educating start-up business owners, providing continued mentoring, offering trainings and programs for the various stages of business ownership, and being there to aid and support when a situation or question arises.

COVID-19 forced us to discover new ways to continue our work in a virtual setting, to engage and interact over the internet. We look forward to returning to in-person events, trainings and networking events that equip aspiring business owners with the technical knowledge they need to be successful. We delight in being part of an exciting journey where people come to us with their ideas and goals, and we help develop the business strategies and plans to bring those ideas to fruition.

I am proud of the work we do. When I look around our community, I see businesses that were once on rocky footing, but now are thriving after completing our training sessions, receiving one-on-one counseling, or networking with other business owners at WBC events.

The impact we are able to bestow in communities has allowed business owners to provide for their families, create jobs, build economic development, and make dreams come true. I feel a tremendous sense of achievement in the strides we have made to keep moving the needle towards larger goals and impact. I am looking forward to continuing to walk in purpose and serve our clients and our communities.

Sincerely,

Sara A. Crawford, Program Director

AURORA ACADEMY

OF HAIR DESIGN

Michelle Aurora, Founder

Imagine this scenario: You open a school because you have a passion for helping people learn a profession that they will love for the rest of their careers. Then a pandemic shuts down and limits your business for more than a year. Closing takes away more than your way to make a living, it takes away your reason for getting out of the bed in the morning. more >

Carnicería Camargo

Jose Pedro Camargo Rodriguez, Founder

Hard work pays dividends

Exactly 20 years ago, Jose Pedro Camargo Rodriguez came to America from Moroleon, Guanajuato, Mexico, spoke no English and brought only his dreams, energy and diligence. more >

The Juice Joint

Renee Sellers and Lanice Wilson, Founders

Lanice Wilson credits her daughter for beginning the journey that ended with the Juice Joint at Wilmington’s Riverfront. It began with a visit to her daughter in California – the epicenter of natural and whole food eating — some six years ago. Intrigues, Lanice tried a fresh juice for breakfast one day and became a convert to healthy eating. more >

La Palma Contractors

Aaron La Palma, Founder

Twenty-five years in the contracting business hasn’t diminished Aaron Luna Nava’s commitment to excellence and the values of integrity, professionalism and diligence in residential and commercial home improvement and construction. That commitment, combined with hard work and attention to detail led to La Palma developing a reputation as the area’s go-to construction company. more >

Parker Restauración y Construcción, Inc.

Michael Parker, Founder

Una parte importante de la planificación empresarial es identificar el mercado específico al que se prestará servicio dentro de su sector. Michael Parker comprendió que existía una gran competencia en el sector de la construcción en general y finalmente creó un nicho en el que ahora es un reconocido experto. more >

Peruchos

Jose Elera, Founder

“We specialize in chicken – like (that well-known chicken) Market but with flavor. Peruvian Flavor.” That’s how Jose Elera describes Peruchos’ signature dish, one of the many tasty Peruvian dishes on the menu at his family-business restaurant on Rt. 40 in Bear, DE. more >

Portabellos de Kennett Square

Sandra Morris and Chef Brett Hulbert, Founders

Combine la experiencia de una exitosa carrera en el sector inmobiliario y la experiencia de 30 años de aclamada gestión de cocina y cocina profesional, y tendrá el equipo perfecto para crear un restaurante hermoso y exitoso en la ubicación perfecta. more >

SEED Eatery

Yauhen Yurhelevich and Dmitry Gorin, Founder

En circunstancias ideales, abrir una startup implica un nivel de riesgo que muchas personas simplemente no pueden tolerar. Entre las startups, un restaurante es uno de los más arriesgados. more >

Finanzas

True Access Capital Statement of Financial Position

| ACTIVOS | 2020 | 2019 |

|---|---|---|

| Cash and Cash Equivalents | $3,286,568 | $1,659,686 |

| Restricted Cash | 2,835,721 | 2,895,277 |

| Investments | 48,515 | 48,467 |

| Grants Receivable, Net | 140,051 | 199,496 |

| Miscellaneous Receivable | 24,161 | 25,545 |

| Accrued Interest Receivable | 168,019 | 65,760 |

| Prepaid Expenses | 54,446 | 34,792 |

| Servicing Asset | 38,371 | 57,289 |

| Loans Receivable, Net | 7,503,994 | 6,131,427 |

| Equity in Investment - Related Party | 258,393 | 257,201 |

| Security Deposit | 1,427 | 1,427 |

| Property and Equipment, Net | 184,898 | 191,475 |

| TOTAL ASSETS | $14,544,564 | $11,567,842 |

| LIABILITIES AND NET ASSETS | 2020 | 2019 |

|---|---|---|

| Accounts Payable | $29,633 | $44,547 |

| Accrued Expenses | 21,532 | 20,479 |

| Deferred Revenue | 1,899 | - |

| Compensated Absences | 57,997 | 41,529 |

| Loan Escrow | 18,245 | 16,555 |

| Participation Balance Due to DEDA | 62,432 | 62,432 |

| Paycheck Protection Program Loan - Conditional Grant | 159,275 | - |

| Loans Payable, Net | 8,728,041 | 7,660,311 |

| Bonds Payable | 500,000 | - |

| TOTAL LIABILITIES | 9,579,054 | 7,845,853 |

| NET ASSETS | 2020 | 2019 |

|---|---|---|

| Without Donor Restrictions | 2,128,093 | 1,517,345 |

| With Donor Restrictions | 2,837,417 | 2,204,644 |

| TOTAL NET ASSETS | 4,965,510 | 3,721,989 |

| TOTAL LIABILITIES AND NET ASSETS | 14,544,564 | 11,567,842 |

Inversores y colaboradores

Los inversores

Artesanos Banco

Barclays Bank of Delaware

Condado de Kennett

Católica Iniciativas De Salud

Citizens Bank

Los Clientes Del Banco

Fundación Comunitaria de Delaware

Primera Iglesia Unitaria de Wilmington

Google

HSBC Bank USA, N. A.

M&T Bank

Fideicomiso del Norte

Oportunidad De Financiación De La Red

Las hermanas de San Francisco de Filadelfia

TD Bank, N. A.

USDA — Rural Development

Administración de Pequeñas Empresas de EE. UU.

WSFS Banco

Individual De Los Colaboradores

Paul Altman

Peter Calder

Gloria Diodato

Vandell Hampton, Jr.

Deborah Harrison

Jimmy Jarrell

Daniel Kempski

Jonathon Klass

Greg Ladner

Delores Lee

Phyllis McCollum

Keith Pettiford

J. Pratt-Fields

Clinton & Mary Robertson

Clinton Tymes

Aziz Semanas

Barb Willis

Neil Wright

Los colaboradores

Artesanos Banco

Fundación Benéfica del Banco de América

Barclays

Barnes & Thornburg

Capital One

Citi Foundation

Citizens Bank

La ciudad de Wilmington

Comenity Banco

Institución Financiera de Desarrollo Comunitario

Los Clientes Del Banco

Delmarva Power

Descubrir Banco

Economic Development Administration

Google

HSBC Bank USA, N. A.

JPMorgan Chase Foundation

Losco & Marconi

M&T Bank

Meridian Bank

Oportunidad De Financiación De La Red

PNC Bank

El Banco De Santander

TD Bank, N. A.

USDA - Rural Development

U. S. Small Business Administration

Wells Fargo Fundación

WSFS